Overview

OPPLUS, a Malaga-based company specializing in business consulting and optimization, has for 16 years been working with its client BBVA, one of the leading financial institutions in Spain and internationally. With a high volume of customer service inquiries from a commercial office network and seeking a more efficient and scalable model, OPPLUS turned to Inbenta for an AI platform purpose-built to optimize customer experience. By implementing Inbenta’s self-service and automation tools, OPPLUS and Inbenta transformed the customer support model and enhanced the user experience.

In just 12 months, calls to the commercial office network fell from 71% of all interactions to 11% — an 84% improvement.

Challenge

OPPLUS’s expanding business required more efficient and scalable customer support that kept service quality intact. The demand for personalized attention by phone or email was significant and growing, with peak wait times exceeding 4 minutes and customer abandonment as high as 12%. To solve the challenge, OPPLUS created a knowledge database with up-to-date information for agents handling inquiries. It also analyzed the feasibility of making this operational knowledge available to BBVA’s network of banking offices.

Solution

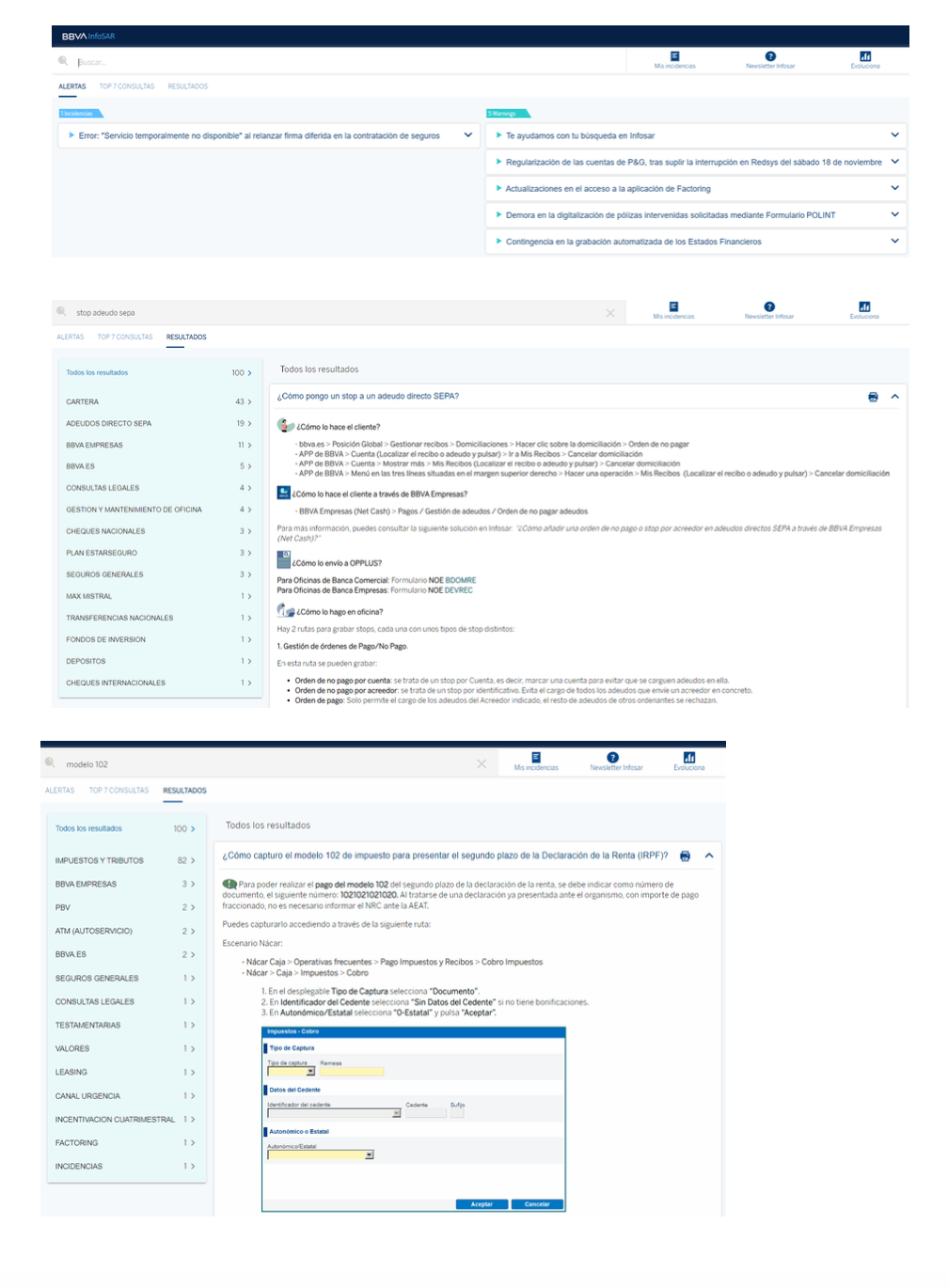

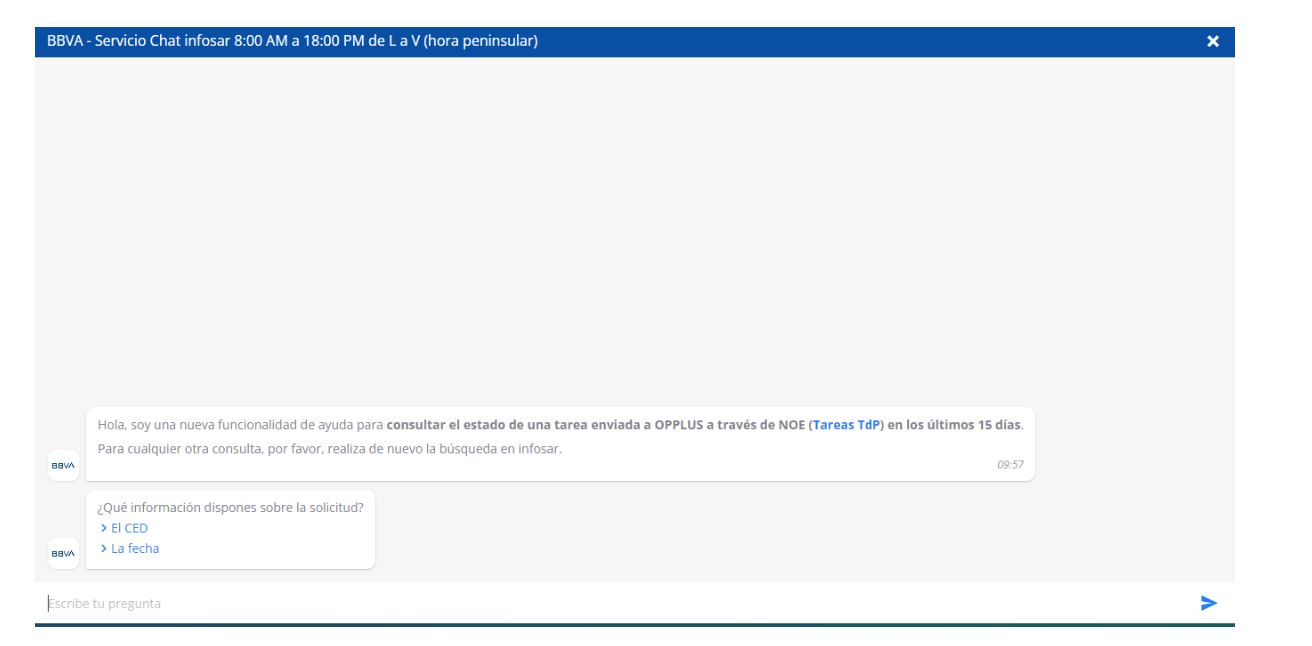

OPPLUS aimed to transform the traditional customer service model, which relied on two-tier phone-based support, to a new model prioritizing customer self-service. They did so by integrating Inbenta’s AI self-service platform, internally referred to as Infosar. OPPLUS’s Business Intelligence team implemented new technology, including a chatbot, knowledge management tool, live chat and an incident management system, shifting the focus to self-service resolution and improving the operational efficiency and overall customer experience.

OPPLUS applied the following Inbenta products:

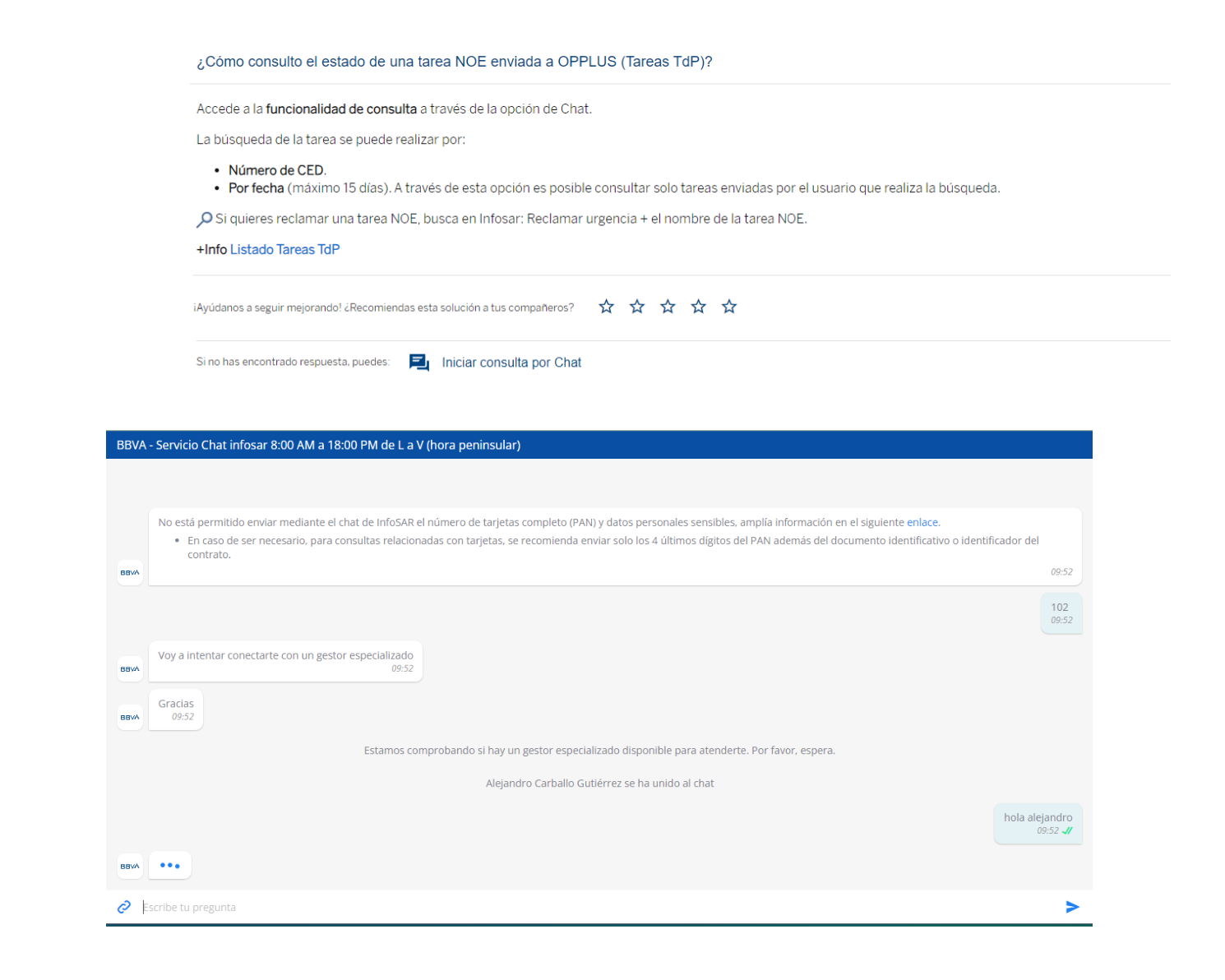

Chat

Inbenta’s chatbot provided independent responses to service inquiries, autonomously managing issues and only escalating them to managers when necessary. The result was fewer escalations, reduced wait times and an improved customer experience that promoted self-service.

Knowledge

Inbenta’s knowledge management tool organized the extensive content library created by OPPLUS, making it easier for agents to find the latest, most relevant information.

It shifted the updating and organizing of content from a manual process to an automated one. Prior to implementing Knowledge, each support team would be tasked with maintaining and updating its own content, which resulted in a lack of uniformity and consistency in the language and messaging.

Assist

Inbenta’s agent-assist tool was deployed to facilitate communications between network office users and OPPLUS service agents. It also served as an incident management system, helping both teams prioritize and escalate complex or urgent customer service needs. In addition, Assist allowed for instant communication through live chat to resolve complex customer issues faster than by phone.

Results

Implementing Inbenta’s AI-enabled self-service platform brought transformative improvements for OPPLUS and its customer service operation, exceeding KPIs.

By the numbers:

- 99.09% automated response rate

- Demonstrating the effectiveness of the Inbenta platform.

- 100% self-service rate

- Effectively transforming the customer service model away from issue escalation to the management team.

- 73.89% click-through rate

- Indicating high engagement with Inbenta’s solutions.

- 86% Net Promoter Score (NPS) with OPPLUS’s messaging and incident platform

- Reflecting overall user satisfaction with their ability to prioritize and collaborate on customer service issues.

- 60% decrease in customer service calls to the management team

- Reflecting a clear increase in self-service capabilities.

- 69% increase in Chat and Assist use

- Highlighting a demand for accessible information.

- 60% positive content valuation

- Showcasing the impact of Inbenta’s knowledge management capabilities.

- 60% improvement in cost efficiency

- Highlighting how AI can improve productivity and optimize service.

The successful collaboration reinvented BBVA’s customer service model, shifting toward automation and OPPLUS’s frontline agents to address service inquiries.

The result was transformational: The shift from relying on escalation to solve customer service issues to AI-powered self-service streamlined operations. It not only substantially improved customer self-service rates but also their satisfaction, ultimately resulting in more seamless and cost-effective service.