Digital transformation has affected almost every industry, as organizations try to gain a competitive advantage and cater to changing customer demands. The banking sector has also recognized the game-changing effects innovative technological disruptors like Artificial Intelligence (AI) can have and acted promptly to optimize their online and mobile banking models with customer interaction platforms.

Digital Banking Moves Forward With Bank Chatbots

Covid-19 has accelerated the deployment of these technologies even further. Despite the increase in online banking, banks hadn’t expected not having face-to-face contact with people for a prolonged time or not having employees working in their offices. Banks are consequently preparing themselves to meet these challenges in the future and to not fall for the same mistakes. This means responding efficiently to challenges such as outbreaks and finding solutions that can guarantee business continuity regardless of any crisis.

Social distancing has altered how people purchase goods, communicate and work, and banks have had to reduce their dependence on humans, when possible, to become a lights-out business that meets customer demands for 24/7, omnichannel access to services.

Whether it’s for processing transactions, consulting information, and accessing customer service, banks today need to invest in improving their contact points with consumers beyond their branches or outsourced call centers, and digital solutions have provided the banking sector with a competitive advantage.

AI and Automation Are Powering Digital Banking

For years, customers have been demanding more from their financial institutions. Covid-19, and the consequences that came from the pandemic only accelerated these customer demands. Consumers expect immediacy, personalized, and flawless interactions with their favorite brands and they expect the same from their banks. There is little surprise then that the new wave of digital banking is all about customer experience.

Banks need to improve the quality of their customer service without sacrificing time to redundant user queries. Subsequently, they now understand the importance of automation and 24/7 services that are not only convenient to them, but to their customers. This means seamlessly providing scalable 24/7 customer support on multiple channels and languages.

Chatbots in the Banking Industry

To reach this objective, banks need robust platforms that can guarantee these deliverables, and provide immediate assistance to clients, whether they need to:

- transfer money;

- check account balances; or,

- make additional requests.

They need intelligent platforms that can interact with these customers and understand what they are trying to say. They need intelligent chatbots.

Customers can benefit from receiving personalized assistance on the channel and language of their choice, but so too can employees. Chatbots do not need to pose a risk to human agents, as their role is not to replace workers, but rather boost their productivity by allowing employees to focus on more complex tasks that require their knowledge and talent while reducing support costs and increasing customer retention rates.

Discover the Solutions

Guiding Consumers Towards Digital Self-Service: The Future of Chatbots in Banking

Digital services have become mainstream features in nearly every sector. Any service that can be delivered online, is technically a digital service. Banks have not fallen behind in providing digital services and have been catering to customer demands for self-service for some time now. With many customers preferring to carry out transactions on their own, without needing to queue to meet a bank employee or respect working hours, banks provide self-service capabilities like Kiosks or ATMs. The combination of digital services and self-service is a different matter.

Leveraging digital services and AI to deliver personalized, omnichannel services while allowing customers to self-serve and carry out their own actions is a key element in the future of customer service and customer experience. This is where chatbots have become integral features of digital self-service solutions.

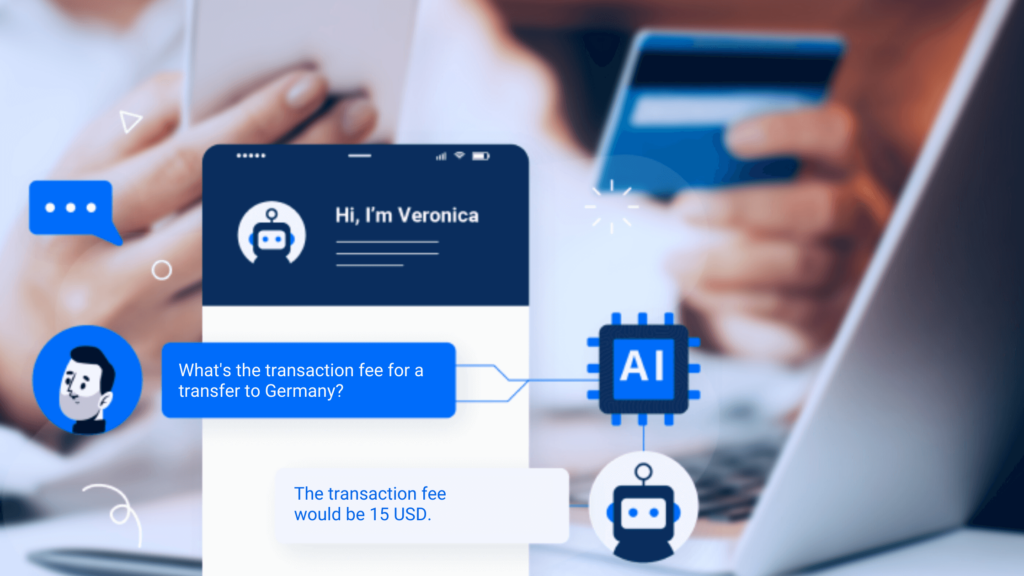

Chatbots in banking can help streamline transactions like money transfers and account balance checks via a conversational interface so that customers are constantly guided through their actions. Chatbots can facilitate access to banking information and FAQs from any page on a bank’s site, while additionally providing tailored information by leveraging customer data to deliver recommendations and tips to customers in an automated way.

With these capabilities, there are many actions customers can carry out without needing assistance from a human agent, such as receiving bill and payment notifications, getting fraud and suspicious activity alerts, transferring money, checking their balance, or reporting stolen cards to name a few.

Chatbots allow customers to manage requests swiftly and efficiently while acting as a listening channel so that banks can better understand user habits, anticipate customer actions and deliver personalized offers and services. By contextualizing products and services, banks increase their customer loyalty and their lifetime value.

Employees also benefit from chatbots, as these reduce operational costs, minimize human error and save human agents time on repetitive queries so that they can focus on more complex issues or on training to gain new knowledge and capabilities. According to a study by Juniper, chatbots will save banks up to $7.3 billion worldwide by 2023, allowing them to compete with other branches and deploy a successful digital transformation.

In short, chatbots will not replace human agents. In fact, by automating standard procedures, human agents will have to focus on more demanding issues. However, chatbots can seamlessly escalate queries to customer agents while providing them with all the necessary data to ensure that these issues are resolved appropriately and without having to make the customer repeat any information.

This type of deployment is crucial for financial companies to carry out their digital transformation and thus be able to compete with the giants of the industry, but what is the best use for customer interaction management for banks.

Chatbots in Banking and Financial Services: Use Cases

The experiences chatbots provide must be as similar to a human agent as possible. That means providing more than simple Q&As, but rather presenting alternatives and offers, anticipating their needs, and providing insights when convenient.

Banks need to engage with their customers in the right way and in the right channels. Integrating chatbots as part of their engagement processes can improve customer satisfaction, reduce costs and deliver valuable qualitative and quantitative feedback on customer demands and opinions.

Banks using chatbots and self-service solutions

It is no surprise then that so many banks are already looking to deploy chatbots to optimize their digital transformation strategies. Here we will showcase some examples:

BforBank optimizes its 100% online customer service by improving its self-service capabilities

One bank that has notably benefited from the deployment of chatbots is BforBank. As a neo-bank integrated into the Crédit Agricole group, the 100% online bank focuses on autonomous, active, and mobile customers and caters to its customers digitally. In order to lighten the workload, while delivering 24/7 services and reduce contacts with low-added value, BforBank called on Inbenta to integrate solutions that would optimize their customer service.

Along with deploying dynamic FAQs, forms, and contact pages, Inbenta has set up a chatbot on the bank’s mobile application that totals an average of 850,000 visits a month. The chatbot automatically responds to user queries 24/7, easily retrieving information and boosting online satisfaction and customer autonomy, and will be able to escalate to human agents at the customer’s request.

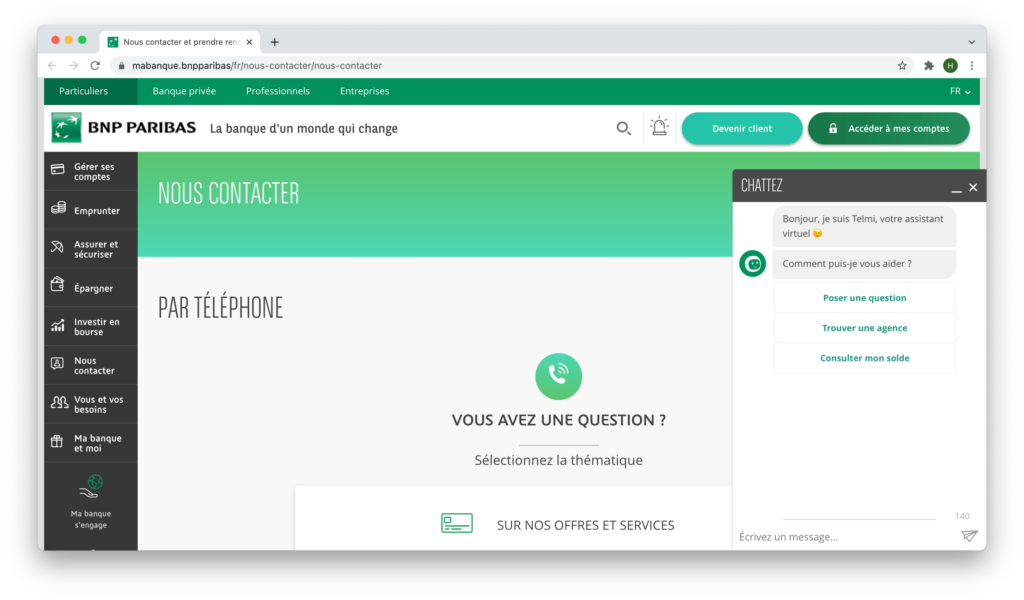

BNP Paribas develops conversational experiences with Inbenta

With banks needing to access their customers on digital platforms and multiple channels, the largest French bank, BNP Paribas chose Inbenta to improve the conversational experiences on their website. Along with providing a virtual assistant to allow customers to check their accounts, offers, and carry out transactions, BNP Paribas is also available on Messenger, Twitter, and Facebook as well as providing a dynamic FAQ to ensure that clients can contact the Bank or find the information they need over a wide array of channels.

Best AI Chatbots for Banking

Chatbots can transform banking experiences for customers, and these banks must choose the right platforms to deliver the capabilities that meet new customer demands. Inbenta’s chatbots allow banks to interact with their customers on their favorite channels at any time of the day. Numerous integrations can optimize customer service by automating end-to-end processes with enhanced FAQs and omnichannel chatbot capabilities that use symbolic AI to power its Natural Language Processing technology, enabling it to understand human languages in all their variations.

Banks can engage with their customers and allow them to access their information, check accounts or apply for cards or insurance without having to visit their branch. Banks can also reduce support costs and see how their agents receive valuable support from chatbots that can reduce the number of incoming contacts by 40% on average and provide agents with customer details when queries are escalated.

With customer satisfaction being a key brand differentiator, Inbenta’s chatbots can allow agents to improve response times, boost customer loyalty and deliver personalized experience by listening to what customers say and write and delivering results to keep banks ahead of the curve.