Policyholders are in control. They’re turning to online channels for self-service insurance information and support — instantly, seamlessly, and at any time. According to a 2021 report, 50% of customers rank digital communications as a high priority (but only 17% of insurers use them).

So digital transformation is no longer an option for insurance firms, but a necessity. And chatbots that harness artificial intelligence (AI) and natural language processing (NLP) present a huge opportunity. In fact, using AI to help humans provide effective support is the most appealing option according to insurance consumers.

In a market where policies, coverage, and pricing are increasingly similar, AI chatbots give insurers a tool to offer great customer experience (CX) and differentiate themselves from their competitors. They can respond to policyholders’ needs while delivering a wealth of extra business benefits.

Let’s take a look at 5 insurance chatbot use cases based on the key stages of a typical customer journey in the insurance industry.

Insurance chatbot use cases for policyholders

1. Discover: Answer frequent questions

Often, potential customers prefer to research their options themselves before speaking to a real person. Conversational insurance chatbots combine artificial and human intelligence, for the perfect hybrid experience — and a great first impression.

AI chatbots can be fed with information on insurers’ policies and products, as well as common insurance issues, and integrated with various sources (such as an insurance knowledge base). They instantly, reliably, and accurately reply to frequently asked questions, and can proactively reach out at key points.

What’s more, conversational chatbots that use NLP decipher the nuances in everyday interactions to understand what customers are trying to ask. They reply to users using natural language, delivering extremely accurate insurance advice.

Top benefits for your business:

- Provide a positive first interaction, with no time spent on hold waiting for an available agent.

- Increase conversions by engaging and interacting with every visitor, on your website and other channels.

- Scale customer service and support while keeping headcount to a minimum, thereby reducing costs.

2. Buy: Generate quotes, sell services and products

For customers who have researched their options and are now ready to buy one of your insurance policies or products (or upgrade an existing one), an insurance chatbot can make the whole process simpler and more user-friendly with:

- insurance plans explained in simple terms

- easy-to-read, jargon-free information

- personalized recommendations

- immediate, tailored quotes in seconds

- step-by-step forms (no need for phone calls).

AI chatbots act as a guide and let customers keep in control of their buyer journey. They are also a great tool to encourage purchases. They can push promotions in a specific timeframe and recommend or upsell insurance plans by making suitable suggestions at exactly the right moment. This facilitates data collection and activity tracking, as nearly 7 out of 10 consumers say they would share their personal data in exchange for lower prices from insurers.

Insurance chatbots can also provide all the supporting details a new customer needs to sign up and proceed with the client onboarding process or help existing policyholders upgrade their plans.

What’s more, chatbots support an omnichannel approach. This allows customers to move seamlessly from one communication channel to another in their buyer journey, without having to repeat themselves and with information being instantly available to a human agent if needed.

And once a new customer has bought their first insurance policy, product, or service with a provider, chatbots can give them a friendly welcome and provide links to common questions, from how to file a claim to any necessary documents the insurer might need from them.

Top benefits for your business:

- Gather valuable data and insights to help provide a highly personalized experience and content.

- Support diversification by recommending, cross-selling, or upselling appropriate products.

- Push relevant promotions and increase campaign conversion.

- Grow your user database with the contact details collected by the chatbot in every interaction.

3. Use: Receive claims, update policyholders

An AI-powered chatbot makes sure customers get help, quickly. Being available 24/7 and across multiple channels, an automated tool will let policyholders file insurance claims or get urgent support and advice whenever and however they want.

For processing claims, a chatbot can collect the relevant data, from asking for necessary documents to requesting supporting images or videos that meet requirements. Customers don’t need to be kept on hold, waiting for a human agent to be available.

Using information from back-end systems and contextual data, a chatbot can also reach out proactively to policyholders before they contact the insurance company themselves. For example, after a major natural event, insurers can send customers details on how to file a claim before they start getting thousands of calls on how to do so.

This is yet another challenge for insurance teams. Following such an event, the sudden peak in demand might leave your teams exhausted and unable to handle the workload. This is where an AI insurance chatbot comes into its own, by supporting customer service teams with unlimited availability and responding quickly to customers, cutting waiting times.

Top benefits for your business:

- Complement other tools like online chat to avoid customer service teams being overwhelmed.

- Speed up average handling times (AHT) and increase first-contact resolution.

- Prevent fraud, resulting in significant savings (detected motor insurance fraud was valued at £602 million in 2020).

- Chatbots can detect inconsistencies in a claim, report fraudulent details and escalate to the right person.

4. Ask: Provide account access and support

AI-powered chatbots let policyholders easily and instantly manage their accounts and access customer support across multiple channels and at any time, with no waiting around or being left on hold until a human agent is available to help.

For example, policyholders can use an insurance chatbot as a customer portal to:

- ask questions about current plans (such as coverage and specifics) and get instant answers, without scrolling through the small print

- check expiry dates, renew policies and products, and consult invoices

- inquire about missing insurance payments and report errors

- request information about refunds, cancellations, and discounts

- update personal and payment details, and submit documentation.

In the event of a more complex issue, an AI chatbot can gather pertinent information from the policyholder before handing the case over to a human agent. This will then help the agent to work faster and resolve the problem in a shorter time — without the customer having to repeat anything.

At all times, users will experience a highly personalized interaction, with tailored responses that draw on data provided by customers themselves as well as that gathered by the chatbot and other analytics tools.

Top benefits for your business:

- Provide consistent, accurate information using automation, for better customer service.

- Reduce workload and free up support agents to focus on more complex, higher-value tasks.

- Boost employee job satisfaction and productivity, and reduce staff turnover.

5. Engage: Get feedback, receive complaints

Insurance chatbots make it easier for policyholders to submit valuable feedback on your insurance products and customer service once their inquiry has been dealt with. Quick, user-friendly options to encourage them to share their experience include:

- button options or rating systems in the chatbox

- text field for comments at the end of the conversation

- short surveys in the chatbox (or sent via email)

Policyholders also want to be able to make complaints online. A chatbot can collect all the background information needed and escalate the issue to a human agent, who can then help to resolve the customer’s problem to their satisfaction.

Top benefits for your business:

- Gather valuable analytics for monitoring chatbot performance

- Access chatbot transcripts for reviewing conversations and making improvements

Case Studies & Chatbot Examples in the Insurance Industry: Insurance Companies Using Chatbots

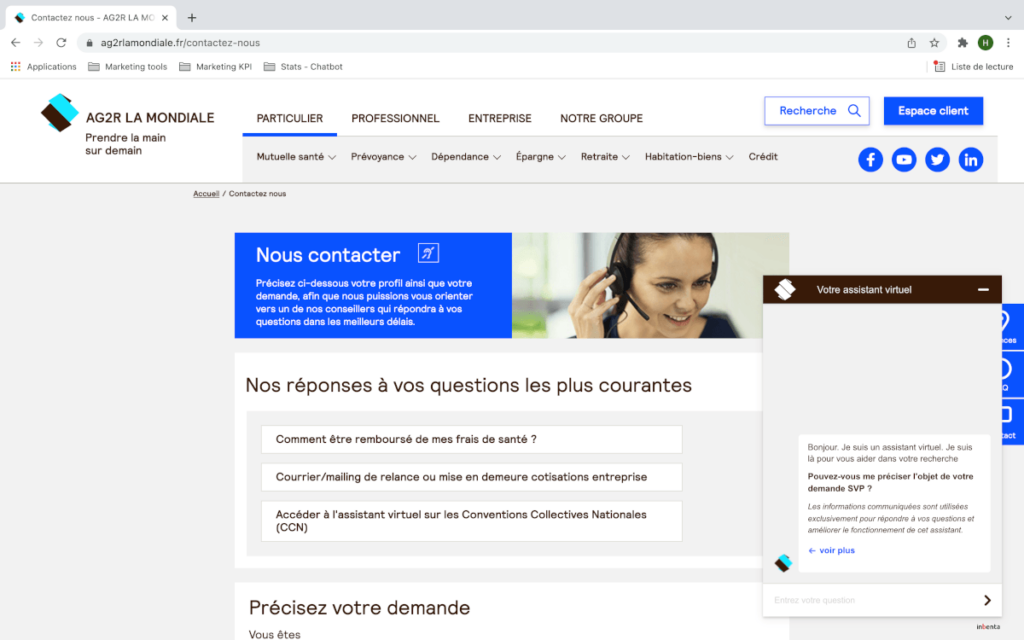

Insurance chatbot example #1: AG2R

Leading French insurance group AG2R La Mondiale harnesses Inbenta’s conversational AI chatbot to respond to users’ queries on several of their websites. With 2 different chatbot instances and a dedicated AI-based FAQ.

Currently, their chatbots are handling around 550 different sessions a day, which leads to roughly 16,500 sessions a month.

- Two-thirds of them happen on their contact page, which gives an idea of how many contact demands might be deflected.

- One-third is happening on their collective work convention page.

- 5% to 10% from within the client area.

The insurance chatbot has given also valuable information to the insurer regarding frustrating issues for customers. For instance, they’ve seen trends in demands regarding how long documents were available online, and they’ve changed their availability to longer periods. This has led to a quantifiable overall increased customer satisfaction.

Insurance chatbot use case #2: DKV

Health insurance provider DKV uses the Inbenta chatbot across its main online channels to improve its CX. Known as ‘Nauta’, the insurance chatbot guides users and helps them search for information, with instant answers in real-time and seamless interactions across channels.

The insurer has made their chatbot available in the client area, but also in their physician search page and their blogs.

Using AI and machine learning, Nauta is trained to respond to queries, offer useful links for further information, and help users to contact a human agent when necessary. It is available 24/7 and can deal with thousands of queries at once, which saves time and reduces costs for DKV.

Ready to build one of the best insurance chatbots?

Insurance customers are demanding more control and greater value, and insurers need to increase revenue and improve efficiency while keeping costs down. AI chatbots can respond to policyholders’ needs and, at the same time, deliver a wealth of significant business benefits.

With global insurance spending on AI platforms set to reach $3.4 billion by 2024, now’s the time to take the lead. The insurers who know how to use new technologies — in the right place, at the right time — to do more, faster, for policyholders will be the winners in the race to deliver an unbeatable CX.

Inbenta’s conversational AI insurance chatbot provides best-in-class customer service by automating support, identifying and promoting relevant products, and simplifying processes — 24/7, in real-time and across key digital channels.